The June 2025 housing market is sending mixed signals—again. After five straight weeks of rising mortgage rates, we finally saw a modest dip: the 30-year fixed average has fallen to 6.85% from 6.89%. For many, this feels like a much-needed breath in a high-pressure market. But is it a real opening or just a brief pause?

Let’s break it down.

What’s Really Happening?

- Affordability remains the core crisis. Rates may have dipped slightly, but home prices remain high and inventory is still tight.

- Sellers are waiting longer for offers , and buyers are facing fierce competition for quality listings.

- Developers are shifting gears toward creative solutions like converting unused commercial spaces into residential units.

- Equity-rich homeowners are rethinking whether to hold, refinance, or sell outright—especially as maintenance and tax burdens rise.

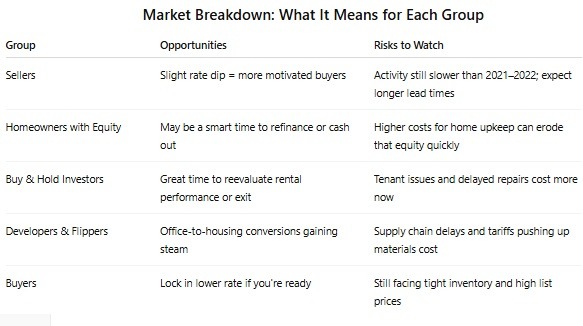

Who Needs to Pay Attention: and Why

At Real Estate Relief, we’ve built our business around understanding these shifts before they hit the headlines. Here’s how we’re helping real people navigate today’s complexities:

1. Sellers

You’re in a better position than you think. The rate dip might not spark a frenzy, but it will bring out more serious buyers. If you’re holding an inherited property, facing tenant issues, or sitting on an underused home, now is a good time to explore a stress-free, cash sale before rates swing back up.

2. Equity-Rich Homeowners

If you bought 5–10 years ago, you might be sitting on gold. But as insurance, property taxes, and upkeep costs climb, that equity can shrink quickly. We help owners analyze their best exit or refinance options —with zero pressure, and total transparency.

3. Buy & Hold Investors

You’ve ridden the wave of rising rents—but maintenance backlogs, late payments, and tenant fatigue are eating into margins. We’re working with investors to offload non-performing rentals , explore creative 1031 exchanges, or partner on office-to-housing projects.

4. Flippers and Developers

Your margins are under attack—from tariffs, supply issues, and shifting zoning laws. But there are also new doors opening. We’ll help you navigate local incentive programs, find distressed properties , or even joint-venture on affordable housing initiatives.

5. Buyers

Is it the right time to buy? Only if you’re ready—and informed. We’ll walk you through rate trends, realistic price expectations, and even connect you with off-market opportunities others miss.

Why Real Estate Relief?

We’re not just another investor group. We’re a people-first, clarity-driven solution for sellers, owners, and investors in Pennsylvania and Florida. Whether you’re looking to sell fast, cash out your equity, or find creative strategies—we’re here to give you options, not just offers.

✔ No fees

✔ No repairs

✔ No stress

✔ Always human-first

Ready to Talk?

📞 Call us now: 305-473-5433 or Visit the relihttps://thereliefpodcast.com/ef podcast to knw more about.

Let’s turn uncertainty into opportunity—together.

Real Estate Relief: Real People. Real Options. Real Results.